Personal Banking

Tools and Resources

Partner Services

Personal Banking

Tools and Resources

Partner Services

Personalized Investing

Expert advice to reach your financial goals.

Wealth Management

For more complex financial planning needs.

Do-It-Yourself Investing

Tools and Resources

Investing Rates

Mortgage Rates

Daily Banking Rates

Loan Rates

About Kindred

Community Engagement

Open an Account Online

Apply for a Loan Online

Why Kindred?

Book an appointment with a Kindred staff member about...

Borrowing / Lending

Investing / Financial Advice

Find answers to your most commonly asked questions about Kindred Credit Union.

Here are answers to some of your most frequently asked questions about personal and business bank accounts, online banking, secure transactions, transferring accounts and much more.

Don't see the answer you're looking for? Use our online appointment tool to schedule a meeting with one of our friendly, knowledgeable staff to answer any questions you have.

Top Questions | Online Banking and Credit Cards | Personal Accounts | Business Accounts | Privacy and Security | Branches, Hours, and Closures | Brand and Media | Credit Unions | Buying a Home | Retirement

In today’s busy world, online banking is a major convenience. You can bank anywhere and at any time. But what happens if you run into a snag? Where can you turn for help? At Kindred, we’ve got you covered 24 hours a day, 7 days a week. Here’s how to know who to call.

Monday – Friday 8:00am-6:00pm

Call our Member Contact Centre at 1.888.672.6728. We have extended hours for your convenience. Our live, local representatives are available to assist you with things like:

When we cannot directly answer you questions, we can connect you with in-branch experts to assist you further.

Outside Business Hours:

If you need assistance to access your accounts online outside of our Member Contact Centre hours, we have technical support available 24/7! Call 1.888.273.3488 for assistance with:

If you need help with any of your online banking needs, please contact us. We’re here to serve you!

Please report a lost or stolen card as soon as you notice it’s missing.

Report a Lost or Stolen MEMBER CARD® debit card:

During business hours, please call our Member Contact Centre at 1.888.672.6728

After hours, please call 1.888.277.1043

Report a Lost or Stolen Mastercard® Card:

Within Canada / Continental US call 1.855.341.4643

Outside Canada / Continental US call 1.647.252.9564

When you open a membership with us, your first $25 is invested in Member Shares. This is not a fee; it’s an ownership stake in Kindred. This investment belongs to you, and is refundable to you if you happen to close your membership. As a member-owner, you have an equal voice in how the credit union is run. Together, as a group of engaged members, we can ensure that Kindred continues to reflect our shared values.

Owners receive Profit Shares!

One of Kindred’s core values is stewardship. As a values-centred, faith-inspired financial cooperative, we’re called to manage the funds entrusted to us with integrity as we walk with our members on their journey to be good stewards of their finances.

For Kindred, stewardship also means giving back to our members and the communities in which we live and work. Kindred remains quite unique amongst credit unions – we continue to share 25% of our annual profits with members. In fact, over the last 10 years we’ve shared $10.5 million with you!

Although the more business you do with Kindred – deposits or loans – the more Profit Shares you receive, all members receive a minimum of $5 each year. Members who have accumulated $50,000 in Profit Shares receive any additional amounts as 100% cash.

Give yourself a Tax break with Profit Shares At any time during the year, members can transfer their Profit Shares funds from non-registered to registered Profit Shares (RRSP) that would then be deductible for tax purposes.

Kindred Credit Union provides you with a variety of interactive online calculators to help you estimate the amount of your mortgage payments, loan eligibility, educations or retirement savings, and more. Once you input your information, you can view the customized calculations in a graph and as a report. You can also print or save your results for later reference.

These calculators are not intended to provide investing or lending advice. We cannot and do not guarantee their applicability or accuracy. All examples are hypothetical and are for illustrative purposes only.

Here is what you’ll need to get started with online banking:

Here is what you’ll need to get started with online banking:

Tip! You’ll find the 16 digits you need on the back of your Access Card, which looks like this picture.

Don’t have your Access Card or Personal Access Code handy? Call our Member Contact Centre at 1.888.672.6728.

Logging in for the first time:

The Kindred mobile app is available on iPhone and Android devices. With a host of convenient features, it's a fast and secure way to handle everyday banking wherever and whenever it suits you. Be sure to stay up to date with the latest version of our app in order to receive the best and most secure mobile banking experience.

Download the Kindred Credit Union mobile app for Apple and Android.

It just got easier to manage your Kindred Collabria Mastercard account! Personal cardholders can now log in to Kindred’s Online Banking to view Kindred Mastercard transactions, and other Collabria credit card account information, all in one place. Here is how you get started!

Personal cardholders, you can access your account information online using CardWise Online or download the CardWise Mobile App for iPhone or Android devices.

Business cardholders, you can access your account information online using MyCardInfo Online.

These platforms allow you to view your balance, set up automatic monthly payments and more, with security and ease!

It’s easy for you to add a payee in online banking or on our mobile app.

You can search for a new payee by name. You can also browse by type, such as cable companies, or utilities* Once you have located the payee, add the required account number, and then click on Add Payee. For some high-risk payees, you may be required to provide a 2-step verification code. Read more about 2-step verification here.

*If the company you are looking for is not on this list, please contact us. Member demand is one of the factors that will be taken into account when revising the list. We strive to ensure that all members across Ontario have the ability to use Online Banking to pay for basic services.

How does 2-Step Verification work?

In addition to entering your password when logging in, a one-time use verification code will be sent to you via text message, voice call, or email. The code must be submitted to access your account online.

Why is Kindred requiring 2-Step Verification?

Kindred is requiring that all members to use 2-Step Verification as an added layer of security. 2-Step Verification is safer than remembering the answers to challenge questions. Cyber threats such as malware and phishing attacks are becoming increasingly sophisticated. A stronger, more secure authentication process involving a verification code will provide an additional layer of security.

Can I opt out of 2-Step Verification?

No. 2-Step Verification provides an extra layer of security to protect your accounts in case your password is ever compromised. All members with online banking are required to enroll in 2-Step Verification.

When will I need to use 2-Step Verification?

A risk engine will determine when it’s appropriate to prompt you for a 2SV code. The risk engine takes multiple factors into consideration, including user behavior (e.g. time, location, etc.) and device (e.g. browser, internet connection, device type, etc.). You may be prompted with 2-Step Verification:

How do I set it up?

You’ll be prompted to set up 2-Step Verification when you log in to online banking or our Mobile App after September 12, 2023. Simply follow the prompts on screen to get started.

Can I mark a device as “safe” to be asked for a 2SV code less often?

Yes. A checkbox will appear on the device (i.e. browser or app) to be asked for a 2-Step Verification code less often when logging in on that device. You may still be asked when conducting other transactions online.

Do verification codes expire?

Yes. Verification codes are only valid for 10 minutes once generated. Each new code replaces any previous code sent to you.

How long does it take to receive a code?

Codes should be received almost immediately, within several seconds, sent by email, text, or voice call. If you don’t receive a code through the expected contact method, click the link to send another code.

Do I need to do anything differently to use online banking going forward?

The way you log in to your accounts can change as we upgrade technology and enhance security features. To maintain uninterrupted access to your accounts you must use your Access Card to login to online banking. This number is different than your MEMBERCARD debit card number. Here's what you should do:

Enter your Access Card number the next time you log in to online banking (the first eight digits may or may not be pre-filled; don't include the dash).

Can't find your Access Card or don't have a record of your Access Card number?

No problem, just give us a call at 1.888.672.6728 and we'll be happy to provide it to you.

Can I register multiple 2-Step Verification contact methods?

Yes. When you first enroll, you can enter only one choice (text, email or voice call) to receive notifications. However, you can update your contact information using the Profile and Settings screen to add another notification channel.

The 2SV code was sent to an email or phone number I no longer have access to. What should I do?

Visit any branch or contact our Member Contact Centre. We can help!

What should I keep in mind if I travel outside of Canada?

If you are planning a trip outside of Canada, be sure you will have access to the contact method you are currently using for 2-Step Verification. If you have selected text notification but will not have your usual mobile device with you on your trip, you can update your contact information to receive these kinds of notifications by email.

Follow these steps to change your 2-Step Verification contact information:

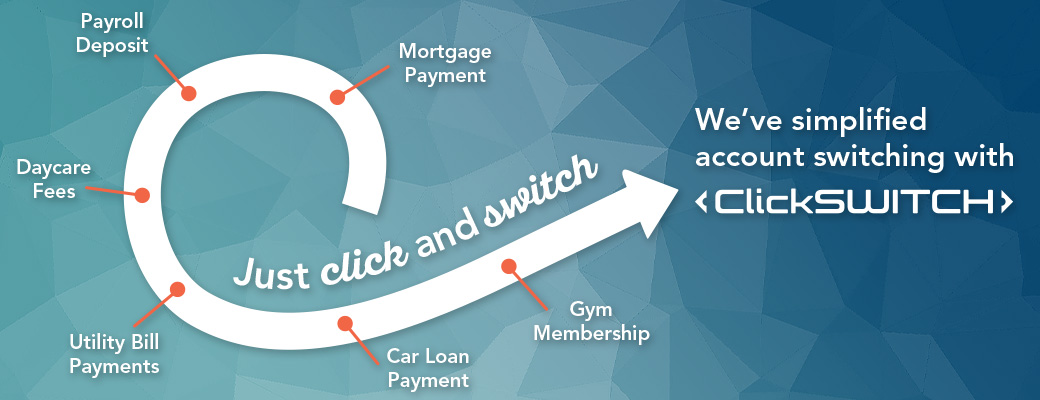

It’s never been easier to switch!

With a personal account at Kindred, you can let ClickSWITCH® take care of moving your direct deposits and pre-authorized payments from another financial institution. In just a few minutes, ClickSWITCH helps you move all your direct deposits and recurring payments to your Kindred account. That means you can skip the task of filling out numerous forms and contacting all your payers and providers. Plus, it helps ensure you don’t miss any payments while you change your primary financial services provider. Simplify and use ClickSWITCH to consolidate all your daily banking to one financial institution!

What you’ll need to begin switching

How it works

What is ClickSWITCH

ClickSWITCH is an automated account switching solution that makes it easy for you to quickly and securely switch your recurring direct deposits and automatic payments from your previous financial institution account to your Kindred account.

How does ClickSWITCH work?

ClickSWITCH removes the hassle of contacting all of your billers and depositors to inform them of your new account information. You input your payment and direct deposit information to the secure ClickSWITCH system, submit the switch, and ClickSWITCH will handle the details for you. You can monitor the progress of your switches by clicking on “View Existing Switches” on your dashboard.

Is ClickSWITCH secure?

Yes. ClickSWITCH uses the latest in online encryption protection to gather and store your switch information. In addition, the highest industry standards are employed to protect your personal information.

What is an automatic payment?

An automatic payment is a regular, ongoing payment that you set up to be paid from your bank account. This may include a monthly insurance bill, utility payment, or automobile loan payment, for example.

What is a direct deposit?

A direct deposit is any payment that you receive from an organization directly into your account. These could include regular pay from your employer, government direct deposits (Employment Insurance, Canada Child Benefit, Canada Pension Plan, etc.), and direct deposits from investment accounts.

How long will it take?

Submitting a switch typically takes less than 90 seconds.

Once a switch is submitted, a company will receive your switch request within 24 hours.

Once a company receives the switch request, automatic payment and direct deposit switches typically take five to15 business days. Since the timeframe depends on the company receiving the switch request, it’s always a good idea to review your switch status page for the most current information for each switch and to continue monitoring your accounts.

Timing for each switch can vary depending on the type of payment or deposit, the biller or depositor, and the method needed to switch the payment or deposit.

When is it safe to move/remove funds from my prior account?

Keeping enough money in your old account to cover each payment until all switches show “Completed” is recommended. This is especially important for any payments that might be due during the 14 day period after you initiate a switch.

How do I know if my payment or deposit has been switched?

If you provided an email address during enrollment and have allowed email alerts, you’ll receive switch updates via email. If not, you’ll need to log in to ClickSWITCH and view the switch status.

The easiest way to check the status of a switch is to look at the “Status” column of your ClickSWITCH account. Switches that have been completed and confirmed by your biller or depositor will display a “Completed” status. Switches that are still in process will display a “Mailed” status.

If any switches have a “Mailed” status for 15 days or more, we recommend contacting the company to confirm the switch is completed, or check your account.

Monitoring your switch status is an important part of moving your account. It’s advisable to keep enough money in your old account to cover each payment until the switch status for that payment has changed to “Completed,” or you’ve confirmed with your billers that your payment account information is updated in their systems.

One of my switches has an “Action Needed” status. What does this mean?

Occasionally, after you have submitted a switch for processing, ClickSWITCH’s research team determines that the company requires you to update your banking information with them directly online. When this happens, your switch will show an “Action Needed” status. You may also see an “Action Needed” status if the switch is rejected for other reasons. To see the details of the action you need to take, you can click on the “Edit” icon in the Actions column.

Why do I need to enter my billing account number or other specific information?

Companies require specific information to ensure your identity and to update the account information in their systems.

Which address should I use for my biller and depositor?

A large number of billers and depositors are already in the system. However, if ClickSWITCH does not have a company’s address, please use the address that’s indicated on the payment confirmation or statement the company sends you. You can also often find the address displayed in the Help or Contact Us areas of the company’s website.

What if I don’t have the information required to submit a switch?

If a field has an asterisk on the right, this information is required in order for the switch to be submitted. If you get stuck in the middle of a switch, you can click “Save and continue later”. It will save with “Information Needed” as the status and you can either log back in later when you have the required information or contact Kindred for help.

What if I forget to include an automatic payment or direct deposit when submitting my switches?

You can easily submit additional switches any time! Simply log in to your ClickSWITCH account and click the correct tab in your dashboard.

Can I use ClickSWITCH to switch my occasional bill payments?

Since these types of bill payments do not recur automatically, you’re not able to use ClickSWITCH to manage them.

I’m having technical difficulties. Who should I contact?

Please contact Kindred’s Member Contact Centre for assistance at 1.888.672.6728.

You can also start the switch by visiting your local branch. We can help walk you through the process. You will still need the information for your existing direct deposits and pre-authorized payments. Use our helpful Account Switching Checklist.

Void Cheque Forms

To set up direct deposits or pre-authorized payments, download our Void Cheque form and send it to each of your depositors/billers. You can also use this form to change your pay deposits with your employer. This form can be downloaded after you log in to online banking.

From a browser, there are three ways you can access a void cheque form:

From the app, the Void Cheque form can be downloaded from the Account Activity screen. Press Accounts, then select the desired account. Expand Account Details and select the hyperlink to Download Void Cheque (PDF).

If you do not currently have access to online banking or the app, you can download a blank Direct Deposit / Pre-Authorized Payment Form.

CRA direct deposit enrolment

CRA direct deposit enrolment for personal and business accounts can be completed online when you log in to online banking. Navigate to Account Services in the left menu, then Set up CRA Direct Deposit.

Personal members can receive the following CRA payments through direct deposit:

Business Members can receive the following CRA payments through direct deposit:

We offer a number of convenient ways to bank, from in person options to remote alternatives.

If you’re not yet set up with our remote banking alternatives, now is a great time to do so. This will ensure you’re able to continue banking with us, even if you’re not able to visit us in person. You can access your accounts in many ways.

Here are the details for all the ways you can bank with Kindred Credit Union, at any time, from anywhere.

Recommended Scanner

You will need to purchase a scanner in order to use Kindred’s Remote Deposit Capture service. At this time we recommend the Panini Vision X Scanner (part number PN1/VX50.1.FFNJ) for members scanning 100 or fewer cheques per day.

This recommended model scans 50 cheques per minute—we believe it’s sufficient for scanning 100 or fewer cheques per day.

Ordering Process

Ensure that credit card and billing information are entered correctly.

Click Submit

Order confirmation will appear onscreen.

You’ll receive an order confirmation email.

If your order is received by 3:30 PM EST, Monday to Friday, your order will ship the same business day.

Once the order has shipped, you’ll receive a shipment confirmation email with a tracking number.

All agreements, support, pricing, and purchasing details for the scanners are between Paystation and the purchasing party.

Training Videos

Full instructions for setting up your scanner and using Remote Deposit Capture are outlined in these step-by-step videos: Remote Deposit Capture Training Videos

Maintenance

Kindred uses cheque scanners regularly in our branches. The most common problem we see is misfeeds. In our experience, it is very important to follow the cleaning and maintenance recommendations to prevent dust and residue build-up, which can result in mis-feeds and general scanning issues.

While hardware warranties are available, delays in completing repairs or deliveries can be frustrating. Please see product manual for full maintenance recommendations, and follow them!

We offer a number of convenient ways to bank, from in-person options to remote alternatives.

If you’re not yet set up with our remote banking alternatives, now is a great time to do so. This will ensure you’re able to continue banking with us, even if you’re not able to visit us in person. You can access your accounts in many ways.

Here are the details for all the ways you can bank with Kindred Credit Union, at any time, from anywhere.

AFT is a quick and cost-effective way for businesses, churches, and non-profit organizations to collect and send payments electronically. Members can easily create Canadian or US dollar transactions to or from accounts at any Canadian financial institution.

Donations

For churches and registered charities, AFT is a convenient, efficient, and reliable way to receive donations on a regular basis. By automating the transfer, you eliminate the need for donors to write cheques or remember offering/donation envelopes. AFT also enables consistent giving throughout the year, allowing churches and registered charities to budget more accurately.

Payroll Direct Deposit

When you arrange for payroll deposits via AFT, you eliminate the need to distribute paper cheques. While AFT isn’t a payroll service, it enables timely and efficient direct deposits – which your staff will appreciate.

Payables and Receivables

AFT reduces the time, effort, and expense needed to manage payables and collect receivables. It also reduces the need to issue or deposit cheques through in-branch services or an ATM.

For business, AFT makes it easier for your customers to make payments on time and improves customer service overall.

How does the AFT service work?

If you think that AFT might work well for your business or organization, speak with your Account Manager. They will help you decide if AFT is a good fit for you. Then,

There are two options to facilitate the processing of AFT transactions.

When you set up AFT services at Kindred, you will enjoy real-time email confirmation of your transactions. And, you’ll be alerted to any processing issues immediately so you can correct the transaction right away.

Once set up, you’ll have access to:

AFT Fees

Please refer to the applicable service fee booklet to review AFT fees for business or organization memberships.

More Helpful AFT Video Guides

You can watch these step-by-step instructional videos for for more information about using the AFT service.

What if I have a question or concern?

For additional support, please contact your Account Manager.

As you may already know, email is not a secure method of communicating confidential information. That’s why we use a secure message system called SecureIT that allows us to communicate electronically with you while protecting your privacy. SecureIT allows Kindred staff members and members to share confidential documents using a web browser. Read this guide for details on how to set up and use SecureIT.

Protecting your privacy and safeguarding your personal and financial information is just as important to us as it is to you.

Kindred offers up to date tips and advice for safeguarding your personal information and protecting your accounts from loss and unauthorized access, as well as information about the latest fraud attempts and scams being tired by crooks, along with instructions for what to do if you think your information has been compromised.

Kindred Credit Union has eight branches in Southern Ontario. We have locations in Kitchener, Waterloo, New Hamburg, Aylmer, Elmira, Mount Forest, Milverton, and Leamington. You can find the closest branch and ATM to you using the interactive map on our Find a Branch page.

Our head office is located at 1265 Strasburg Road, Kitchener, ON N2R 1S6. This is an administration office only. There are no branch services and no ATM at our head office.

Our Member Contact Centre is open from Monday to Friday by phone or email from 8 a.m. - 6 p.m.

Branch Hours

Aylmer, Kitchener, Leamington, Mount Forest, New Hamburg and Waterloo

Monday to Wednesday, and Friday: 9:30 a.m. to 5 p.m.

Thursday: 9:30 a.m. to 6 p.m.

Elmira

Monday to Wednesday: 9:30 a.m. to 5 p.m.

Thursday and Friday: 9:30 a.m. to 6 p.m.

Milverton

Monday to Wednesday, and Friday: 9 a.m. to 5 p.m.

Thursday: 9 a.m. to 6 p.m.

Holiday Closures: Our branches and head office will be closed on the dates listed below for these statutory holidays and observances.

New Year's Day: January 1, 2025

Family Day: February 17, 2025

Good Friday: April 18, 2025

Victoria Day: May 19, 2025

Canada Day: July 1, 2025

Civic Holiday: August 4, 2025

Labour Day: September 1, 2025

National Day for Truth and Reconciliation: September 30, 2025

Thanksgiving Day: October 13, 2025

Remembrance Day: November 11, 2025

Christmas Eve: December 24, 2025 - Early Closing at 3:00pm

Christmas Day: December 25, 2025

Boxing Day: December 26, 2025

New Year’s Eve: December 31, 2025 - Early Closing at 3:00pm

New Year’s Day: January 1, 2026

On-Site Services

In addition to our branches, we offer a weekly presence at Parkwood Mennonite Home in Waterloo each Wednesday from 9:30 to 10:30 a.m. to help residents bank in the comfort of their own home environment.

Extended Area Services

Because we’re committed to our rural communities, we have four drop boxes where rural members can make non-cash deposits. These are serviced by our Elmira, Mount Forest, and New Hamburg branches. Please contact your local branch for more details.

To set up an interview with a Kindred Credit Union representative or to make a media inquiry, please contact:

Frank Chisholm, Director, Brand and Marketing Kindred Credit Union

1265 Strasburg Road, Kitchener, ON N2R 1S6

Phone: 519.746.1010 ext. 5211

Email: frank.chisholm@kindredcu.com

You can read Kindred's latest media releases here.

Please visit this page where you can fill out a short form in order to download Kindred's brand assets, which includes our style guide and various versions of logo.

Credit unions are well-regulated, full-service financial institutions. Canada's credit unions put their member’s hopes, dreams, needs, and wants above all else. Canadians who choose to bank with a credit union are choosing to bank with a conscience. Credit unions give back to their members - the people that bank with them - and contribute to their community’s economic and social well-being.

At Kindred, we welcome all Ontarians who share our values and purpose to join us in working to impact the world in amazing ways. Membership eligibility requirements at other credit unions varies. For example, some credit unions serve individuals who live in a particular area, work in a certain industry, or are employed by a specific company.

You can become a Kindred member by visiting one of our local branches, scheduling a meeting with us, or applying online. You’ll be asked to provide some identification, such as your Social Insurance Number, and complete some information about yourself.

Member Shares are required for new accounts. Your $25 Member Share investment will be covered using funds from your first deposit. Member Shares are a one-time investment giving you an equal voice in how the credit union is run and a share of our annual earnings. You’ll get this back if you ever leave the credit union.

Visit our Membership page for more information.

Kindred offers an interactive online mortgage calculator to help give you an idea of how the amount of a mortgage, interest rates, down payment, and other details can impact your monthly housing payments.

Find out more about how to use the online mortgage calculator tool.

You can view the current residential mortgage rates for fixed and variable mortgages on our mortgage rates page.

See the latest interest rates for Kindred Credit Union lending and investment products and offers.

Buying your first home can seem daunting, but with the right help you’ll be well on your way. Fixed or variable? Open or closed? Amortization? There’s a lot to learn when it comes to buying a home. Get familiar with your home buying options for first time home buyers.

The First Home Savings Account can be a great way for first time home buyers to save money for their down payment to purchase their first home. These accounts offer the benefits of both tax deductions on your contributions and non-taxable earnings.

There are many ways to save for your retirement, but how much do you need? Kindred offers an interactive online retirement calculator to help you find out, so that you can retire comfortably. Planning early is the key to peace of mind.

Find out more about how to use the retirement savings calculator tool.

It’s never too early to start planning for retirement! Not sure where to start? In this video, Darcy explains what a Registered Retirement Savings Plan (RRSP) is, how it works, and what benefits come from having one.

Learn more about Registered Retirement Savings Plans (RRSPs).

© 2025 Kindred Credit Union. All rights reserved. Inspiring peaceful, just, and prosperous communities